Office property is still the most sought-after asset class in Europe according to research by Catella.

The pan-European property advisor suggests that compared with other classes of investment, the office sector attracts the most capital. Nonetheless, Catella's latest survey of investors shows a structural shift towards value-add investment strategies, which are replacing the traditional core investment approach. The report also shows that, compared with major markets like Germany, France and the UK, there is strong investment activity in a handful of markets, including Spain, Norway and Poland, that offer attractive risk-return ratios and good growth potential.

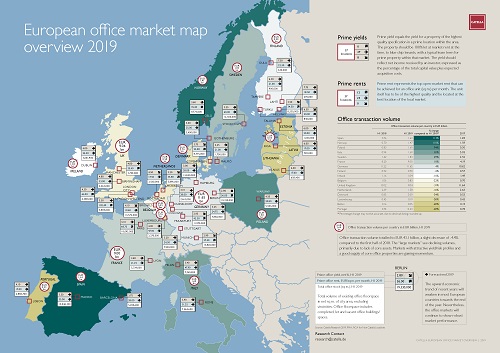

Catella Research carried out a new analysis of the European office market in 18 countries including for the first time Italy, Portugal and Ireland.

At the start of the third quarter of 2019, the European real estate investment market is contending with a weakening economic mood, political uncertainty, high prices and shortages of property, particularly in the core segment. The analysis of Catella’s most recent investor survey in July showed that, in the short term, many investors only intend to reduce their investment in office properties by around 4%. Nevertheless, investments in office property are still the most sought-after asset class in Europe. The transaction volume in the countries analysed by Catella totalled EUR 43.1 bn in the first half of 2019.

Dr. Thomas Beyerle, Head of Research at Catella, comments: "The generally pessimistic mood is not consistent with the quantifiably good market figures. Despite all the external macroeconomic influences, the European office markets remain stable. Thanks to the very good potential for diversification and the heterogeneous yield and rental structure, investors still perceive good prospects for this asset class."

Further results of the analysis:

- Compared with the first half of 2018, the office transaction volumes in Spain, Norway and Poland have soared, in some cases more than doubling. The countries with the lowest transaction volumes and the sharpest declines are the Baltic states, Portugal and Luxembourg.

- Germany was the largest office investment market (EUR 11.65 bn) in this half-year, attracting almost a quarter of the total office investment volume in Europe. The UK and France, each with around EUR 9.0 bn, were next.

- Across the 37 cities analysed, prime office rents have risen to an average of EUR 34.40 per sq m per month, compared with EUR 32.65 per sq m in the first half of 2018.

- The most expensive office market is still London's West End, at EUR 102.40 per sq m per month, although the prime rent fell by ca. 2% in the first half of 2018. The lowest prime rents are in Vilnius, Riga, Rotterdam and Lisbon.

- Yield compression is less evident that in recent years. The average prime yield across all markets is 4.23%, equating to a reduction by only 21 basis points year-on-year. The prime yield in Berlin hardened by only 10 basis points, to its current 2.80%.

- The lowest yields – below the 3% mark – are found in Berlin, Frankfurt and Munich. Next come the other German 'A' markets, Paris, Amsterdam and Stockholm, with yields of up to 3.25%. The cities with the most attractive risk/reward profiles are Lahti (7.75%) and Oulu (7.50%) in Finland.

- The majority of markets will see a stable trend of prime yields and rents to the end of the year. We anticipate that yields will harden in eight European cities and rents will rise in twelve. However, in all cases, the rate of change will be fairly moderate.

- Despite all external macroeconomic influences, the European office markets remain stable and have enjoyed robust market trends in recent years. Increasingly, deal-by-deal transactions are supplanting the traditional focus on core or value-add.

Click to see full image